Online art sales have skyrocketed over the past decade, driven by the digitization of the market and the rise of virtual marketplaces, which we have reviewed. Once the preserve of hushed auction houses and galleries, art is now accessible in just a few clicks. But this democratization comes with new challenges and unprecedented risks.

A rapidly changing market

The figures speak for themselves: according to the Art Basel and UBS report, the online art market was worth nearly $10 billion in 2022, representing 16% of the global market. While the 2020 pandemic acted as a catalyst, specialized platforms such as Artsy, Saatchi Art, and 1stDibs had already begun this revolution long before. Now, even major auction houses such as Christie's and Sotheby's are investing heavily in digital strategies.

The major advantage? Accessibility. Young collectors from the digital generation no longer need to step foot inside an intimidating gallery. With just a few clicks, they can explore a global catalog of works, use augmented reality services to visualize a painting in their home, and bid online. As a result, the profile of buyers is changing, with a lower average age and an increase in impulse purchases.

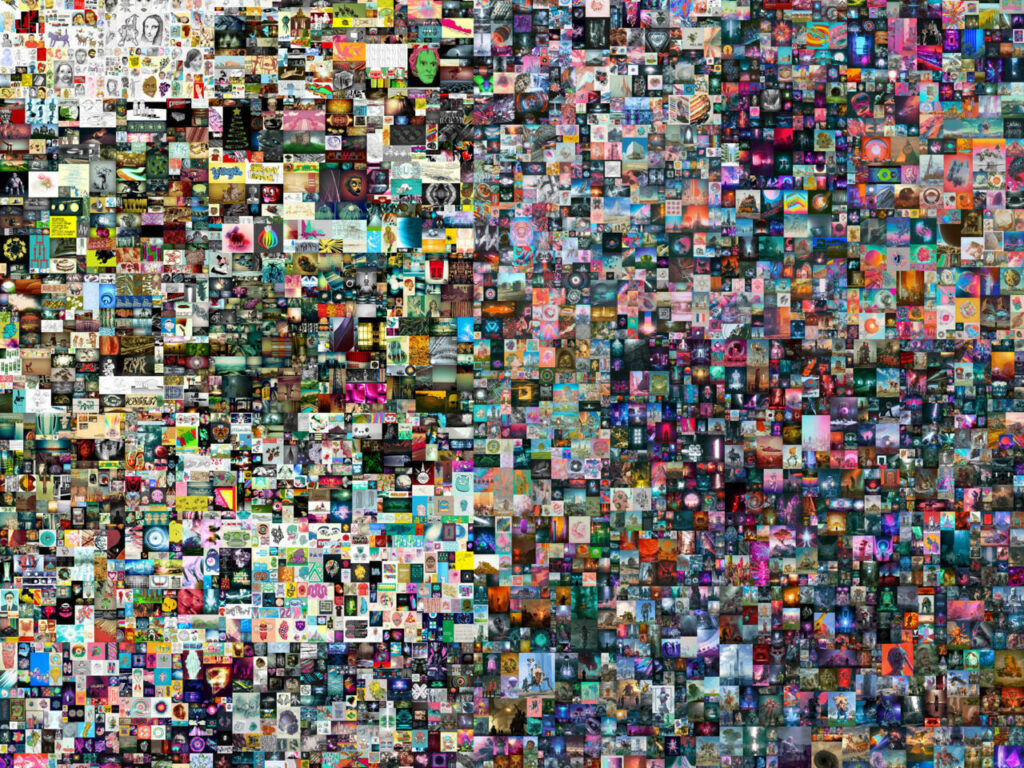

The rise of NFTs: bubble or revolution?

It is impossible to discuss the digitization of the art market without mentioning NFTs (Non-Fungible Tokens). In 2021, artist Beeple broke records with the sale of his digital artwork Everydays: The First 5000 Days for $69.3 million at Christie's. This speculative surge attracted a new audience: collectors of traditional art now rub shoulders with crypto investors.

But since then, the NFT craze has cooled off. Sales volumes plummeted in 2023, and mistrust set in due to numerous scams and fluctuations in the crypto market. Will the NFT market survive the initial craze? Some experts believe this is a necessary correction before stabilization. Others fear a gradual disappearance, except for projects offering real artistic value and exemplary traceability.

The risks: counterfeiting, money laundering, and lack of transparency

While online sales simplify access to art, they also complicate verification. The risk of counterfeiting is skyrocketing with platforms where authentication is sometimes sketchy. Some artists see their works resold without their consent, and auction houses must be extra vigilant about the provenance of pieces.

Another problem is money laundering. The art market, which is largely unregulated, attracts opaque capital. Certain cryptocurrency transactions on decentralized platforms escape financial radar entirely, which is a boon for criminal networks. US and European authorities are beginning to tighten regulations, but the anonymity of buyers and sellers on certain platforms remains a worrying gray area. Earlier this year, Ukrainian President Zelensky pointed the finger at the art market, which allows Russian oligarchs to continue moving their capital around the globe.

Should traditional galleries adapt?

Faced with this digital tidal wave, physical galleries are holding their ground, but they need to innovate. Some are playing the complementarity card, offering a stronger digital presence while focusing on the unique experience of visiting a gallery. Others refuse to embrace the digital model, favoring an exclusive, human relationship with collectors.

While online art sales have proven their potential, they will not completely replace the gallery or auction house experience. Prestigious collectors will continue to seek out works in person, and even young buyers continue to appreciate visual and physical contact with the artwork.

Major auction houses seem to have found the ideal hybrid formula: online auctions that retain the prestige of physical events. As for emerging artists, digital platforms remain an unparalleled springboard, offering them global visibility without having to go through major galleries. Online art continues to shake up the status quo, but to endure, it will need to become more transparent and regulated.

In France, Maurice Lévy launches Your Art

Maurice Lévy, an iconic figure in advertising, launched the digital platform YourArt in 2023, aiming to become the "YouTube of art" by offering artists, whether professional or amateur, a space to exhibit and sell their work. However, the ambition of this initiative, and its risky parallel with YouTube, raises questions about its economic viability.

The online art market is already saturated, with established players such as Artsy, Saatchi Art, and 1stDibs having captured a significant share of the market. The recent acquisition of Artmajeur by YourArt, although strategic, does not guarantee a dominant position against these well-established competitors.

Furthermore, monetizing a platform dedicated to art remains a major challenge. Business models based on sales commissions or subscriptions often struggle to generate substantial revenue. Consolidation in the online art sales sector therefore seems inevitable in the medium term, and we doubt Your Art's potential to succeed in the face of its competitors.